Build A Diversified Energy Portfolio

Co-Investing Alongside Industry Insiders

About The Energy Flex Fund

Active Tax Deductions

Investing in oil and gas provides unique tax benefits through Intangible Drilling Costs (IDC) and Tangible Drilling Costs (TDC).

Intangible Drilling Costs (IDC) covers non-salvageable expenses like labor, site preparation, and drilling fluids—often amounting to 70-80% of total drilling costs. These expenses are 100% deductible in the year incurred, offering immediate tax relief.

Tangible Drilling Costs (TDC) cover expenses for equipment and other physical assets used in oil and gas production, such as rigs, wellheads, and casing. Thanks to accelerated depreciation rules, up to 60% of TDC can often be deducted in the first year, with the remaining balance depreciated over a 7-year schedule.

How Much Can I Write Off

If we modeled a $100,000 investment, potential write offs may look like this across different projects:

New Development Projects: these requires more new drilling, labor, and services resulting in higher IDC.

- IDCs: $85,000 (85%) = $85,000 first year deduction.

- TDC's $15,000 (15%) = $9,000 bonus deduction & $875 regular depreciation.

Total First Year Deduction: $94,857. (95%)

Rework / Recompletion Projects: similar to development, but slightly lower IDC ratio.

- IDCs: $80,000 (80%) = $80,000 first year deduction.

- TDC's $20,000 (20%) = $12,000 bonus deduction & $1,143 regular depreciation.

Total First Year Deduction: $93,143. (93%)

Existing Production Projects: These have lower IDC percentages because of existing infrastructure:

- IDCs: $60,000 (60%) = $60,000 first-year deduction

- TDCs: $40,000 (40%) = $24,000 bonus depreciation + $2,286 regular depreciation.

Total First Year Deduction: $86,286 (86%)

Basic Fund Structure

The Energy Flex Fund is structured to allow investors to partner alongside industry experts in Oil & Gas opportunities with more transparency, control over capital, and an easier ability to diversify than possible in traditional Oil & Gas structures.

Investors participate by buying units into the fund, which are then allocated across a variety of projects of their choosing.

This provides the flexibility to build a custom portfolio diversified across projects that best meet their investment goals and risk tolerance.

What Can I Invest Into

There are many forms of investing into Oil & Gas that you can participate in within the Energy Flex Fund.

- Existing production: these opportunities have current Oil & Gas production, and are a more conservative way to buy into existing cashflow.

- Equipment: another conservative opportunity to buy into the Oil & Gas equipment itself that is used on sites to see potential cashflow from the service provided, regardless of well performance.

- Reworks & recompletions: a more moderate opportunity with higher potential returns to invest into wells that had production but are offline and need some labor to return to production.

- New drills: a more speculative opportunity with substantially high potential returns to develop the land and drill a brand new well.

It's recommended to diversify across several wells and/or opportunities to mitigate risk and maximize the chance of both return of and on investment.

What Are Targeted Returns

We target assets with a potential 1%-2% monthly rate of return that may have opportunity for further development and potential increase in return.

Some of our partners in Q3 of 2024 received over a 14% distribution with as high as a 6% return in a single month on a project initially targeting a 23% ARR.

More recently, some of our partners received a 2% distribution on a new project that is partially completed targeting a 27% ARR, suggesting the potential for a higher-than-expected return.

Not all projects exceed projections, but our acquisition strategy is geared toward projects targeting potential returns of 1%-2% a month in properties that may have further upside and potential return with additional development.

The Flex Fund Difference

We are not the Oil & Gas company selling you a deal. We are investors ourselves vetting opportunities and deploying our own capital into them.

We simply make the projects we are actively participating in available to investors like you to partner with us in order to bridge the capital gap needed to complete the project.

This structure aligns incentives where both parties stand to profit on the performance of the asset itself, rather than the investor holding the entirety of the fiscal risk as is often the case in traditional Oil & Gas structures.

Portfolio Performance: See your portfolio growth and investment performance.

Explore Projects: See our current offerings, projected returns, and more.

Financial History: Track returns, withdrawals, deposits, and more.

Documentation: Access all legal documents associated with your investments.

Portfolio Breakdown: Quickly see each project making up your portfolio.

Field Updates: Get real time updates like you're in the field on all of our projects.

Setup & Funding: Securely setup your profile, transfer funds, and more.

PARTNER WITH THE ENERGY FLEX FUND

Submit The Form Below

Our investor team will share information with you immediately.

BENEFITS OF INVESTING IN OUR MODEL

Why Partner With The Energy Flex Fund?

Cash Flow

Benefit from steady cash flow generated by oil and gas production, insulated from stock market fluctuations.

Diversification

Diversify freely across wells, drilling equipment, and lending opportunities through our unique structure.

Active Tax Benefits

Deduct up to 100% of your investment against your active income in year one, in addition to ongoing benefit and tax breaks.

Growth

As both oil prices and reserves rebound from all-time lows, today's investors are positioned for strong returns.

Risk Mitigation

Experience the advantages of layered protection, reducing investment risks while maximizing potential returns.

Partnership

Navigate the energy market with confidence—invest alongside seasoned industry leaders to avoid costly errors.

Capital Control

Control your capital with zero management fees, no cash calls, flexible withdrawals & easy reinvestment.

Transparency

Get weekly updates on your projects, returns, access paperwork & more via our online investor portal.

OUR DIVERSIFIED INVESTMENT OPTIONS

Assets We Invest In

Lending

Conservative

Equipment

Conservative

Production

Conservative

Recompletion

Moderate

Drilling

Moderate/High

INVESTMENT PROCESS

How The Energy Flex Fund Works

INVESTMENT PROCESS

How The Energy Flex Fund Works

Get Started Easily through our investor portal.

Review Current Opportunities and perform due diligence.

Fund your account like a brokerage account, & Soft Commit to desired projects.

Manage Investments with transparent communication and updates on each project.

See Returns, Reinvest or Withdraw, & Tax Returns all within your Investor Portal.

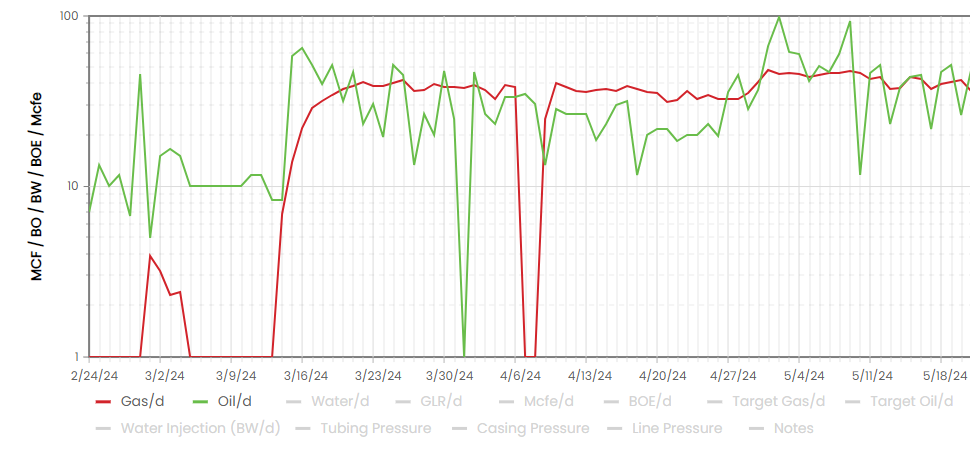

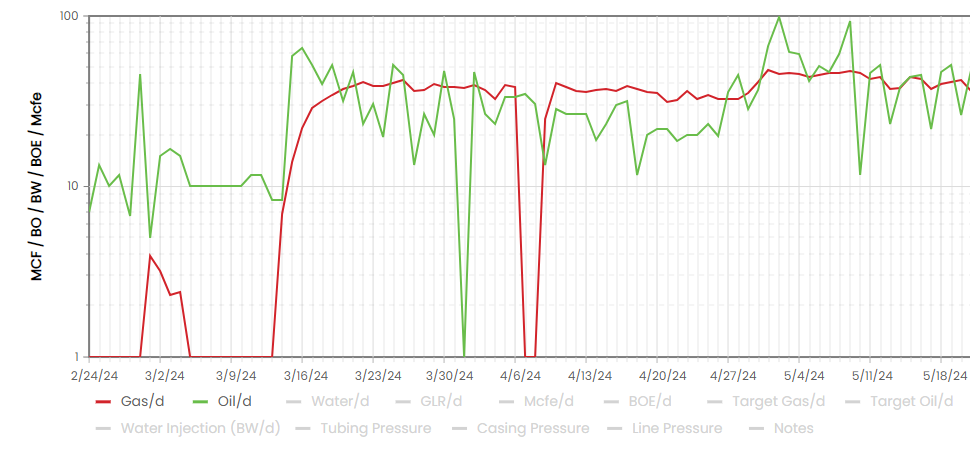

Concho Legacy Production Field

Investment Amount: $850,000

Closing Date: February 6, 2024

$34,000 cash flow to investors for April's production! (Distributed in May 2024)

4% monthly return

This deal has surpassed our projections with only 4 of the 12 wells producing, with more coming soon!

Keep Up To Date With

Live Pricing

Leadership

Meet Our Team

Brent Franklin

Founder & CEO

Serial entrepreneur, mentor and advisor to business owners, investors and entrepreneurs.

Started investing in oil and gas in 2018, became a fulltime oil and gas operator within a year.

Successfully acquired numerous properties and completed many reworks and new drills.

Adam Owens

Investor Relations

Experienced in the oil and gas industry for several years, and successful real estate and tech investor for a decade.

Family background in oil and gas projects for three generations, and professional qualifications and experience in regional sales management.

Marrionna Cook

Fund Specialist

Marrionna Cook, with 20 years of office management expertise, skillfully oversees daily operations and staff in professional settings.

An expert in field operations, logistics, and project management, Marrionna excels at coordinating tasks, managing resources, and ensuring timely project delivery through effective planning and risk mitigation.

Argelia Moctezuma

Fund Manager

Argelia, Chief Operating Officer at Rise Operations and affiliate of Energy Flex Fund, excels in financial management, l operational oversight, and legal support.

Her adeptness in managing finances, streamlining day-to-day operations, and ensuring precise fund allocation underscores her strategic approach.

Brent Franklin

Founder & President

Serial entrepreneur, mentor and advisor to business owners, investors and entrepreneurs.

Started investing in oil and gas in 2018, became a fulltime oil and gas operator within a year.

Successfully acquired numerous properties and completed many reworks and new drills.

Bryan Franklin

CEO

Bryan, CEO of Rise Capital Group, has over 15 years of entrepreneurial and leadership experience.

He excels in data-driven decision-making and alternative investments, ensuring strategic goals are met and instilling investor confidence in his leadership.

Argelia Moctezuma

Chief of Operations

Argelia, Chief Operating Officer at Rise Operations and affiliate of Energy Flex Fund, excels in financial management, l operational oversight, and legal support.

Her adeptness in managing finances, streamlining day-to-day operations, and ensuring precise fund allocation underscores her strategic approach.

Adam Owens

Head of Investor Relations

Experienced in the oil and gas industry for several years, and successful real estate and tech investor for a decade.

Family background in oil and gas projects for three generations, and professional qualifications and experience in regional sales management.

Marrionna Cook

Senior Executive

Marrionna Cook, with 20 years of office management expertise, skillfully oversees daily operations and staff in professional settings.

An expert in field operations, logistics, and project management, Marrionna excels at coordinating tasks, managing resources, and ensuring timely project delivery through effective planning and risk mitigation.

Julian

Burca

Marketing Consultant

Since 2018, Julian Burca has managed multi-million dollar marketing budgets, overseeing HR and technology systems to drive revenue.

With $250M+ in receivables for 900+ international businesses and a successful company exit, Julian offers comprehensive strategic support to organizations.

Barry Wethington

Senior Advisor

Barry is an accomplished Energy Executive with 30 years in global oil and gas.

He managed billion-dollar projects in 8 countries, overseeing P&L, JV boards, and government relations. Barry excels in leadership, technical roles, business development, and mentoring staff.

Sheri Sullivan

Senior Geologist

Sheri Sullivan has 20 years of oil and gas experience.

With degrees in Geology and Geophysics, she has worked globally in seismic interpretation, logging, and field development. She now focuses on asset assessment for mergers, acquisitions, and divestitures, optimizing economic outcomes.